Share

Disability Insurance for Photographers

As the US workforce moves away from full-time, corporate employment to the “gig” economy, more and more people are finding themselves in freela...

As the US workforce moves away from full-time, corporate employment to the “gig” economy, more and more people are finding themselves in freelance positions. This is especially true in the photo industry where the number of staff positions has been dramatically curtailed in the past decade, and where many part-time photographers delve.

When you work for yourself, a slew of additional responsibilities fall on your shoulders including the issue of disability. Whether you’re lugging a hundred pounds of lighting equipment once, or carrying 15 lbs on your back for a few decades, the chances of injury are relatively high. According to the 2004 Field Guide, National Underwriter, by age 40, the chance of becoming disabled for 90 days or more prior to age 65 is 43%. For photographers, this could mean weeks, if not months or years of no income.

Long term disability insurance pays monthly income directly to you in the case of a disabling injury or illness, and can range from a few years to a fixed age. Premiums increase with age, duration of the benefit period and benefit amount (which is typically about 60% of your income).

Key terms:

Elimination Period

The elimination period is the time between your disability event and when a policy starts issuing a benefits check. A shorter elimination period (e.g. 30 days) will yield higher monthly premiums. A 90 day elimination period is common, but depending on your financial situation (e.g. lack of savings), you need to consider which elimination period makes the most sense for you.

Benefit Period

The benefit period is the length of time that you can collect a check from your insurance policy. It could be as short as a 2 years or as long as your lifetime. The shorter the benefit period, the lower the premium.

Limitations

Each policy is different and different carriers define “disability” differently. Policies typically don’t cover pre-existing conditions. Some policies won’t cover certain types of disabilities like mental illness. Make sure you read the fine print.

So what’s it cost?

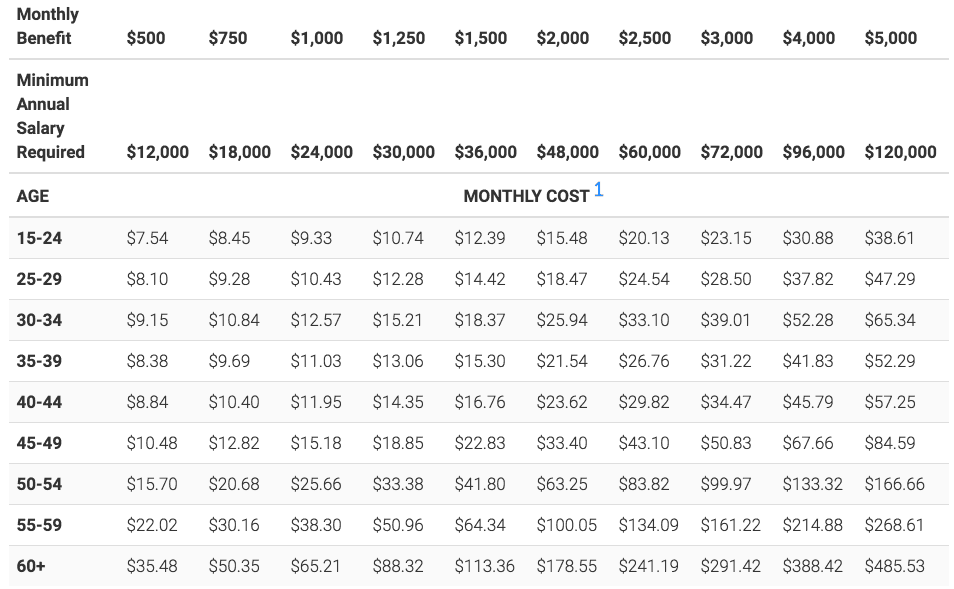

Premiums vary in price depending on your age (probably the most influential factor), income level, elimination period and benefit period. Here’s one example from Freelancer’s Union provided by Guardian with a 30 day elimination policy.

Two photographers without policies

“I had it for a while, but got rid of it. If I recall correctly, between the maximum monthly coverage amount (something like 4k, and that only after jumping through a bunch of hoops) that wouldn’t quite cover my fixed expenses and the lag time between the occurrence and effective period (something like 6 months), the premium (upwards of $500) just didn’t seem justifiable.”

– Texas photographer

“We do not. Used to but several things changed our situation. One, our gallery business has grown which means should I be laid up and not working it wouldn’t be such disaster. Second, I’m old enough to now be taking Social Security (why not) and on Medicare (health insurance that can’t be canceled or the premium raised) so that somewhat changes the imperatives.

“But it is a big issue. Especially with so many publications wanting photographers out there bringing back images from the edges of the earth. I mean, one of the reasons I never wanted to ski was because too many people get injured. I broke enough bones out on the job without adding that risk.

“Finally, it’s always a balancing act, and it’s easy to become insurance poor, totally covered and cash strapped.”

– Kansas photographer

A photographer with a policy

Preston Mack, Orlando, FL

What led you to obtain disability insurance?

This sounds really corny, but I have always been a strong believer in personal responsibility.

I think everyone should do all they can to be responsible (financially) for their own person and family. I realize that sometimes accidents or illness happens, but if everyone made an effort to do this we would all be in a better place. I was a staff photographer for 5 years to start my career. Back then, I only took out life insurance because it was SO cheap and it was one of those cash value plans. It was like forced savings. Over 20 years later, I do have a significant amount of cash reserves there. (I realize that there are many people who criticize these policies saying that you would be better off investing the money yourself, etc, but back then as a young staffer I had no extra money. This was a good way for me to put away money and not think about it).

After I got married, I thought that disability insurance was really important. I was now the primary income source for me and my wife. It would be irresponsible not to have a backup plan. The disability insurance would pay $2500 per month for 2 years. 30 day elimination period. $55/month premium.

At what age did you obtain disability insurance?

I was 30 when I got married, that’s when I got the disability insurance.

You consider disability insurance was more important than life insurance. Why?

I feel that the chances of my randomly dying would be far less than me getting hurt. I already had life insurance in case I died, so disability insurance was the next logical thing. I hope for the best, but you do plan for the worst.

Do you consider disability insurance to be a must-have for freelance photographers?

I know of a few photographers who have went into months long disability spurts with various ailments. I know of one who lost his house and business because of back problems. There is no worse feeling than being unable to provide for your family. I knew that if he had disability insurance, at least they would’ve been able to keep their home and expenses at bay. It would’ve given him a chance to rebound.

I think that especially in today’s volatile freelance climate, these things are essential. Carrying insurance and being a PROFESSIONAL is the difference between a weekend social media photographer and a PRO. It is the cost of doing business.

What other types of business insurance to you currently hold?

I have ALWAYS had camera insurance since I was in college. I was lucky enough to have a mother who bought me my first 300 2.8 and Canon Eos 1 camera body. That was not an easy thing. I have always deeply appreciated that and I know what the value of that money is. Also, if you rent camera gear, having insurance makes it easier. The insurance company will write you a COI, and you can get the gear without putting up the entire value of the rental on a credit card. That way you can rent more stuff, easily and maybe not have to buy all that gear instead.

I also carry business liability insurance. Most of the time, I am on location with lots of lights, light stands and various other liabilities. It would take just one bad accident to sink my company, and honestly liability insurance isn’t that much per year . I have $2 million liability insurance with host of other benefits.

***

Like any non-compulsory insurance, you need to calculate your own risk before obtain what could be a significant investment. If your work consists primarily of studio work, the chance of disabling injury is low compared to an adventure photographer. But you shouldn’t only consider a twisted ankle or bad back. It isn’t unheard of for even young people to be afflicted with chronic disease like cancer, which can remove you from the work force for months, if not years.

Still, the insurance industry works because the majority of the insured never make a claim. Given that so many freelance photographers relentlessly watch their cash flow, their money might be better spent elsewhere.